Learn what landed cost is, how it can dramatically improve and expand your business, and how landed cost can easily be implemented in your WooCommerce or WordPress site.

Landed cost is a term that many people aren’t familiar with, but if you are involved in any aspect of international ecommerce, then you definitely should become familiar with landed cost. This blog will cover the following:

- What is landed cost?

- What are the benefits of landed cost for your ecommerce business?

- How is landed cost calculated?

- How does landed cost work with the UK and EU VAT schemes?

- Are there existing solutions and strategies for landed cost?

What is landed cost?

If you have stumbled upon the term “landed cost” before, it was probably defined as duties and taxes. Duties and taxes are only a small portion of what makes up the full landed cost which is the final price a customer will pay for an international purchase on your ecommerce website.

Landed cost is made up of the following:

- Sum of the product(s)

- Shipping cost

- Carrier fees

- Duty on product

- Duty on shipping

- Tax on product

- Tax on shipping

- Tax on duty

The above list is subject to change depending on where the package is being shipped from and to.

Landed cost includes everything in the above list, and depending on the country or carrier, there may be additional fees such as customs clearance, brokerage fees, or additional taxes.

The full landed cost on the same product will vary depending on the destination country. It would be overwhelming to calculate landed costs on your own. The good news is: you don’t have to. First, let’s explore why you would even want to implement landed cost into your ecommerce business.

The benefits of calculating landed cost for your ecommerce business

Calculating landed cost on your cross-border ecommerce platform is necessary if you want to be competitive in international ecommerce markets. Presenting the full landed cost at checkout gives your customers full transparency of all the costs associated with their purchase. Providing your customers with an accurate estimation or allowing them to pay the landed cost will help improve their experience, and build loyalty and trust between you and your customers. When the customer sees the full breakdown of each landed cost element, they know what they are paying for, which prevents surprises and dissatisfaction.

Present and collect the full landed cost at checkout

We recommend shipping DDP (Delivered Duties Paid) to prevent what may be a surprise invoice to your customer for the duties, taxes, and fees, which have to be paid in order to receive the product.

As the retailer, you can subsidize the carrier fees, or you can choose to collect them from the buyer at checkout. The carrier fees (along with all other fees) should be included in the landed cost, so the customer will understand exactly what they are paying for, and all costs are covered upfront–no surprise fees.

No additional fees upon delivery

Collecting landed cost upfront and shipping DDP avoids a lot of potential problems. These potential problems include customers refusing to pay the surprise fees, experiencing buyer’s remorse, losing trust in your brand, and more. If you don’t provide a breakdown of the landed cost at your WooCommerce or WooCommerce ecommerce checkout, you are at risk of losing those orders and customers. What’s more, you may opt to have the refused packages sent back to you, but with most likely double the fees, it may not even be worth it. Your customers may feel like you, as the retailer, were not being honest with them about the cost.

A lack of landed cost transparency is a common reason chargebacks are issued. If consumers are unaware of additional fees, then they may submit a chargeback with their credit card. This can be quite costly for retailers because they will often lose the inventory, have to refund the customer, and receive fees in addition to less competitive rates from their credit card processing companies. Chargebacks are a concern for many ecommerce stores and might prevent them from going international.

Do not risk the potential success of your business

As an online retailer wanting your consumers to be able to trust your business, building and maintaining that trust is your responsibility. Estimating and prepaying the full landed cost can help the package clear customs faster, allowing your customers to trust that you will get their orders to them promptly. Don’t risk losing future business with your international and local consumers as well as any business you may lose through negative reviews; be transparent, efficient, and trustworthy by making these fees available at checkout.

How is landed cost calculated?

Simply providing a duty and tax estimate, or even allowing your cross-border customers to prepay duty and tax isn’t enough. This can still result in additional surprise fees. The full landed cost covers all fees that are necessary to get the package into your customer’s hands. The calculation of landed cost is complicated because every country has different tax rates and import costs; on top of that, the type of item being imported will change the rate as well.

Looking at the difference between orders to the United Kingdom (UK) and European Union (EU) is an excellent way to see how landed cost differs by country.

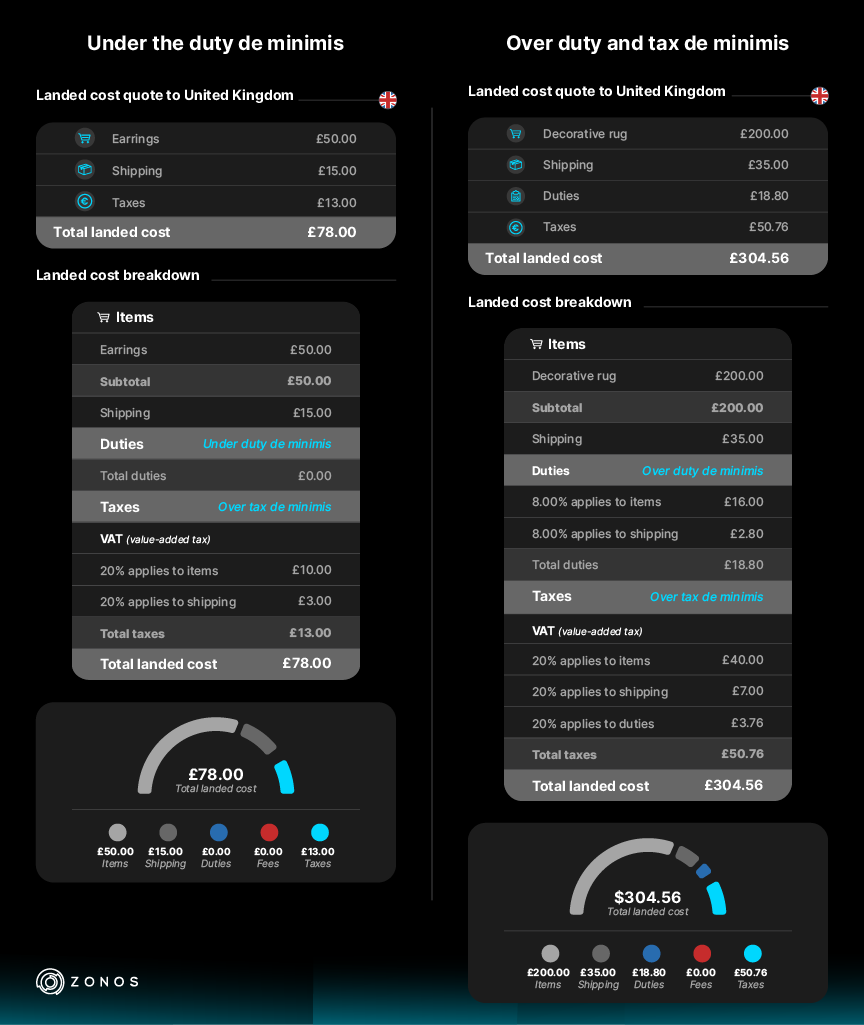

A landed cost quote going to the United Kingdom:

The UK has a tax de minimis of £0.00 and a duty de minimis/threshold of £135.00, meaning every single shipment to the UK will be charged VAT, but only shipments over £135 will be charged duty.

As seen in the examples above, 20% VAT is applied to the item, shipping, and duty costs on both orders.

A landed cost quote going to the European Union:

The EU has a tax de minimis of €0.00 and a duty de minimis/threshold of €150.00, meaning every single shipment to the EU will be charged VAT, but only orders over €150 will be charged duty.

As seen in the examples above, Germany’s 19% VAT is applied to the item, shipping, and duty costs on both orders, but please note that VAT rates vary by EU country.

You’ve seen examples of how the landed cost is calculated in two unique countries, and if you knew the HS codes and duty rates of the items, you could probably calculate it yourself if you had to, but it would be a lot of work. And do you really want to? And what about calculating landed cost for all the other possible countries you’d like to ship to?

Existing solutions and strategies for landed cost

Zonos Landed Cost

Zonos can easily calculate duties, taxes, and other fees for you without making you give up any control of your business or wasting time with manual quotes.There are existing WooCommerce/Wordpress plugins that provide some landed cost services, but not with the automation, abilities, and accuries that Zonos delivers. Zonos can provide the full landed cost at checkout through available plugins and APIs for WooCommerce and WordPress. Unlike many existing solutions, Zonos Landed Cost gives your customers peace of mind, knowing that there won’t be any surprise fees after checkout.

Zonos Landed Cost Guarantee

Zonos’ Landed Cost provides the most accurate calculations on the market, and when paired with, Zonos Landed Cost Guarantee, Zonos’ white-glove international tax management service, you can have total peace of mind with your international shipments.

Zonos Landed Cost is compatible with WooCommerce using their latest API.

Zonos Quoter

Zonos Quoter allows you to get instant duty and tax quotes to make your life easier. Don’t worry about ever having to calculate the landed cost in your head, by hand, or even with a calculator. The UK and EU quote examples above were calculated with Zonos Quoter.

Recap

Calculating landed cost may appear to be a somewhat complex process. Still, by understanding all the components of landed cost and having access to the right tools for your eCommerce platform or with the additional help of an eCommerce developer, it’s easy. Creating transparency in landed cost by implementing the strategies we’ve discussed, will curate positive customer experiences, retain loyal customers, and exponentially increased revenue.